dxy (dollar index) , eur/usd long term analysis & setups till Dec 2022 to April 2023 (27th August,2022)

- :

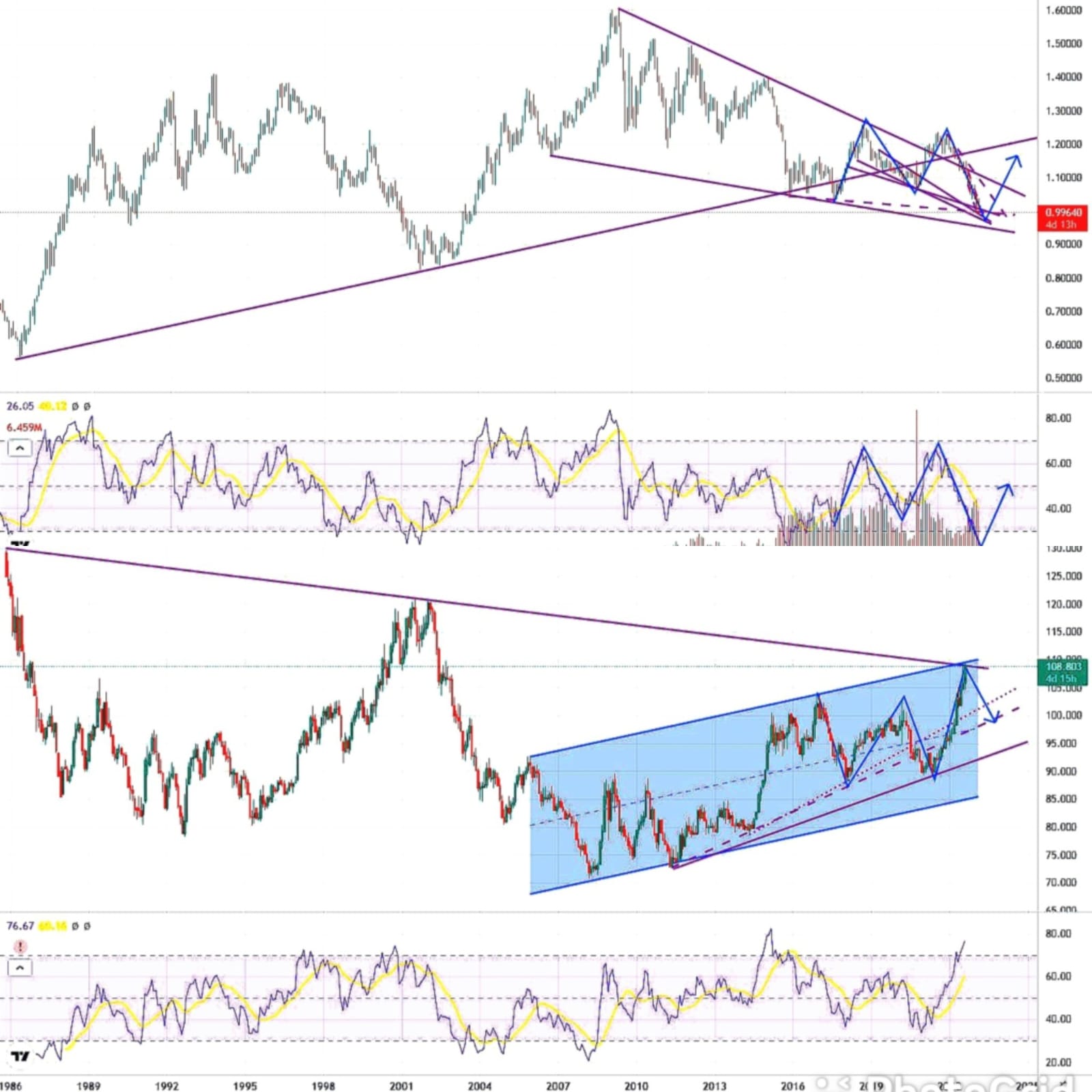

attached is the chart of eur/usd (above panel) monthly & dollar index ,dxy, (below panel) monthly.

RATIONALE:

Technical View:

- first chart, recently eur/usd has broken the 38 years long trend line (1984-2022) amid russia ukrain war weighing in on energy & driving the pair lower as all European business models for next 10 years were dependent on cheap gas from Russia. The broken trend line has already smashed the pair down almost 1700 pips but as for the another view the pair is coming to the support of long term falling wedge(2005-2022) represented by 2 parallel lines. Many other comparatively short term patterns like wedge, channel , bullish bat as presented in the chart with small lines are almost creating the confluence area around 0.96700-0.98200.

- second chart, dxy (dollar index), almost touching the 37 years long resistance line (1985-2022) as a safe heaven demand and fed rising the rates aggressively & driving the dollar higher but comparatively near view is dxy is working inside rising channel (2005-2022) & coming to resistance of the same channel along with long term resistance line as said earlier forming the confluence area around 109.650 along with some other setup of rising wedge inside another rising wedge , bearish bat.

*** DXY is forming almost tweezers top (monthly) with channel resistance & long term resistance line with some weekly Rsi divergence***

Fundamental View:

- at Jackson hole symposium, Jerome Powell sounded very hawkish about raising the rates, but let’s connect the dots through recent datas, 2 q/q negative gdp, slumping housing market, declining PMI numbers & inflation already cooling off since last 2 months & they are expecting the unemployment to rise in 2023,,, won’t let them to hike aggressively & we are expecting 50bps in September & 25 bps in coming months only. They can’t be that aggressive or they will throw the economy under the bus & recession.

- on the other hand ECB is looking to hike aggressively , even doves are getting hawkish tones. yesterday only Knot, Hoizmann, Kazaks, Schnabel, even Villeory ( 5 ECB members) said they are considering hiking the rates in September by 75 bps and 50 bps in coming months. These hawkish statements are going to support eur/usd to climb & recover some ground.

*** other important information is provided to only the subscribers & members***

PLAN :

Buy eur/usd between .98200-.96780 ( conservatives) , .99200 ( risk seekers) for the target of 1.06700-1.08700-1.10700 for the time period of December 2022 to April 2023.

Sell dxy (dollar index) between 110.250-110.750 for the target of 100.90.

Thank you,

Sanjay Galani, CMT, CFTe