EUR/USD medium-longterm buying setup & DXY short (double confirming our previous call of triple screening), 19th June ,2022

- :

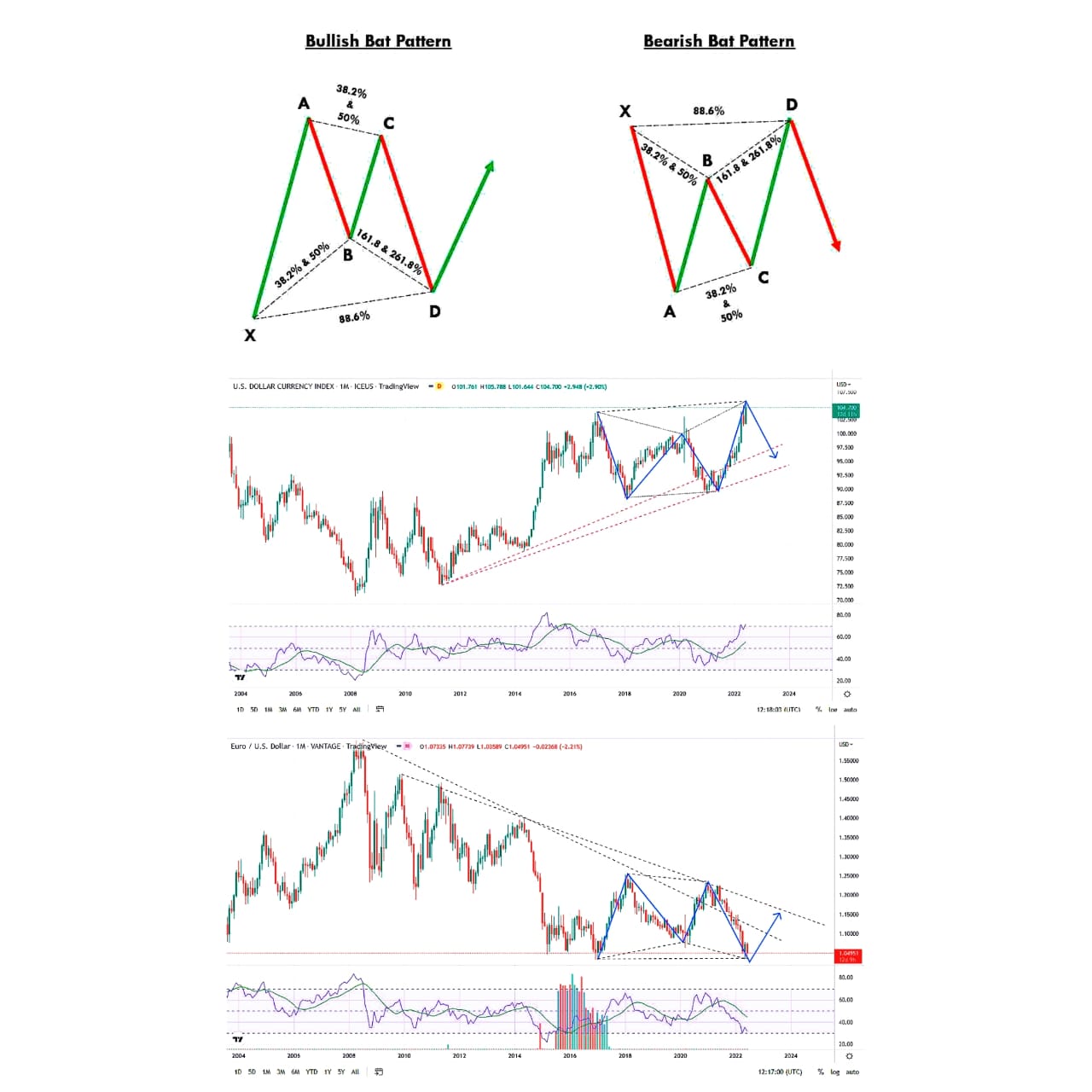

Attached is the chart of DXY (dollar index) & EUR/USD Monthly time frames with general Bat pattern for understanding.

Technical View:-

first part of the chart is general understanding of how the Bat Pattern works for retracement.

Second part attached is the DXY (Dollar Index) has been in uptrend for months as a safe heaven demand after Russia-Ukraine war & Federal Reserve Hiking the interest rates. As indicated in the first part of the chart, dxy has now formed the Bat Pattern & looking for some correction now till 96 as indicated by the blue arrow.

Third part is the monthly EUR/USD has been in downtrend following the war & aggressive selling as it affected the Euro Area the most. But same as indicated above has now formed bullish monthly Bat Pattern & looking for retracement till 1.14000.

In our previous call we indicated the EUR/USD buying pattern with our exclusive triple screening pattern too. This confirms our Technical View on High Probability EURO buying set-up.

Fundamental View:-

1) first time over the decade ECB will start raising rates & will stop bond buying.

2) markets think ECB will raise once 25bps but its indicative from the certain members of ECB that they will raise rate 2 or better 3 times this year itself.

3) Fed has been raising rates too & they will do the same but markets have already been pricing in hikes already.

4)ECB will have to control the inflation by raising rates aggressively & it won’t be a surprise they may raise by 50bps.

5) Fed has been raising rates but there is already chatter about cutting the rates from January 2024 itself, so market will start price in that too. US may be heading into recession whether anyone accepts it or not & that will hit the US Dollar the most.

Plan:-

Buy the EUR/USD between 1.03700-1.04500 for the tgt of ultimate tgt of 1.14000, time period should be maximum of August 2023.

Sell the DXY 104.700 for the tgt of 96, time period being the same as maximum August 2023.

special consideration should be taken if EUR/USD CLOSE below .99200 for 1 week then Euro could be in the long term downtrend till .83000 (probability is very very low for that 2 ot 3%)

Thank You

Sanjay Galani, CFTe

*marketcrafts.co.in*